Principal reduction calculator

Schedule also gives them a way of checking that the lenders are correctly allocating the payments between interest and principal. Loan and Debt Templates This page is a collection of various Excel Templates to manage debt and loans.

Loan Prepayment Calculator Saving Lakhs On Home Loan Now Getmoneyrich

Initial Monthly Interest.

. When you begin making the new lower payment after the recast this will result in paying less principal each month. This calculator works out the land transfer duty often referred to as stamp duty which applies when you buy a home by yourself or with another person and claim the pensioner duty exemption or concession. The calculator below estimates the amount of time required to pay back one or more debts.

Additionally it gives users the most cost-efficient payoff sequence with the option of adding extra payments. For example a 30-year fixed-rate loan has a term of 30 years. If the first few years have passed its still.

You may pay amounts above the new lower payment to pay down principal faster. The monthly interest payment will go down each month but for purposes of comparing the interest to the principal payment the initial monthly interest payment and the initial monthly principal is shown. Which include risk of loss including principal.

Explore the annuities calculator from TIAA to help you save more for retirement. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. Then use this Debt Reduction Calculator to simulate adding this amount to your existing loan payment and Calculate Debt Reduction Savings This will motivate you to continue when you see how small additions to principal compound into huge savings over time.

How to calculate simple interest. The simple interest calculator is a simple and easy online tool to calculate the interest amount. To name a few our selection includes various loan payment calculators credit card and debt reduction calculators payment schedules and loan amortization charts.

Mortgage calculator with graphs amortization tables overpayments and PMI. Debt Paydown Calculator Compare rates. Monthly Mortgage Payment PI.

This calculator just may be the only one on the internet that is capable of creating and allowing users to print a single schedule with exact due dates. Mortgage loans usually have 15 or 30-year terms. We can provide you with costs and complete details.

There are loan templates with a total of downloads. See how your loan balance decreases fastest. Our amortization schedule calculator will show your payment breakdown of interest vs.

The cap rate calculator alternatively called the capitalization rate calculator is a tool for everyone interested in real estateAs the name suggests it calculates the cap rate based on the value of the real estate property and the income from renting itYou can use it to decide whether a propertys price is justified or determine the selling price of a property you own. Our mortgage payoff calculator can show you how making an extra house payment. 51 ARM IO 71 ARM.

Principal Years Start month Start year. The Loan term is the period of time during which a loan must be repaid. To calculate the simple interest you need to input three essential details in the simple loan calculator-.

You can accomplish the same goal all by. Auto loans are usually between 2 and 5 years. Eligible pension cardholders can claim a once-only exemption or concession from duty when they buy a property they intend to use as their principal place of residence.

30 year fixed refi. Amortization is the process of paying off a debt with a known repayment term in regular installments over time. Put the values in the following formula - a p1 rt where a amount.

Reduction of benefits and may contain terms for keeping them in force. Derived from the amount borrowed. Calculate the amount of money you can set aside each month.

Extra payments count even after 5 or 7 years into the loan term. Include a note on your extra payment that you want it applied to the principal balancenot to the following months payment. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

You can change formulas to tweak your needs our. The following calculator makes it easy for homeowners to see how quickly they will pay off their house by making additional monthly payments on their loan. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

Enter your investment goals and information to see how much you can save. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Mortgages with fixed repayment terms of up to 30 years sometimes more are fully-amortizing loans even if they have adjustable rates.

Because the principal of a TIPS is proportional to inflation as measured by indices such as the CPI TIPS acts as a relatively effective hedge against periods of high inflation. This is the amount that is paid each period including both principal and interest PI. They usually only make up very small portions of peoples portfolios but anyone seeking extra protection can choose to allocate more room in their portfolio toward TIPS.

This calculator utilizes the debt avalanche method considered the most cost-efficient payoff strategy from a financial perspective. I designed the Ultimate Debt Reduction Calculator UDRC. Annual Interest Rate APR Also known as the annual percentage rate it is applied to your credit card purchases that were not.

Principal paid and your loan balance over the life of your loan. This means you will pay more interest over time than if you made a principal reduction and continued making the higher payment. Significant principal reduction cuts years off your mortgage term.

Balance Owed The total outstanding balance you must pay including interest. Principal Paid The amount of your payments that paid principal. This calculator assumes a fixed interest rate and the interest is compounded each period.

Consists of both principal P and interest I. Dont shell out your hard-earned cash for a fancy-schmancy mortgage accelerator program. 15 year fixed refi.

Term of Loan in Years.

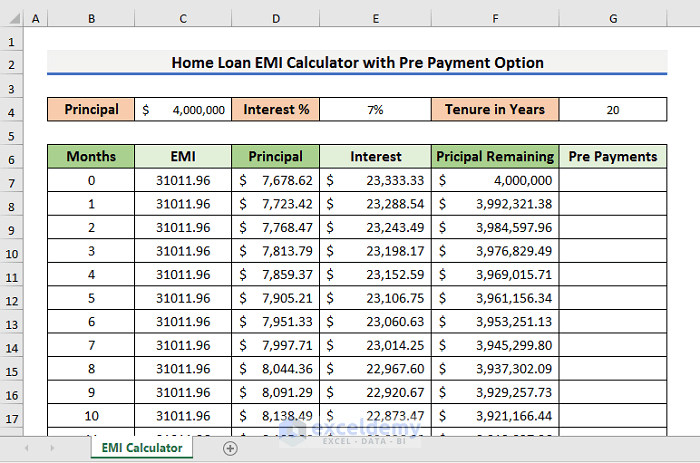

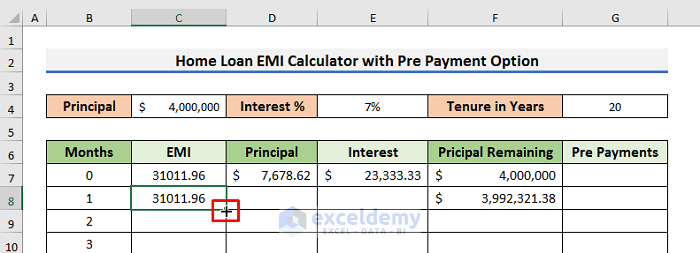

Create Home Loan Emi Calculator In Excel Sheet With Prepayment Option

Pay Off Mortgage Vs Invest Calculator

Excel Formula Calculate Principal For Given Period Exceljet

Mortgage Loan Prepayment Calculator

Extra Payment Mortgage Calculator For Excel

Create Home Loan Emi Calculator In Excel Sheet With Prepayment Option

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Free Interest Only Loan Calculator For Excel

Extra Payment Calculator Is It The Right Thing To Do

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

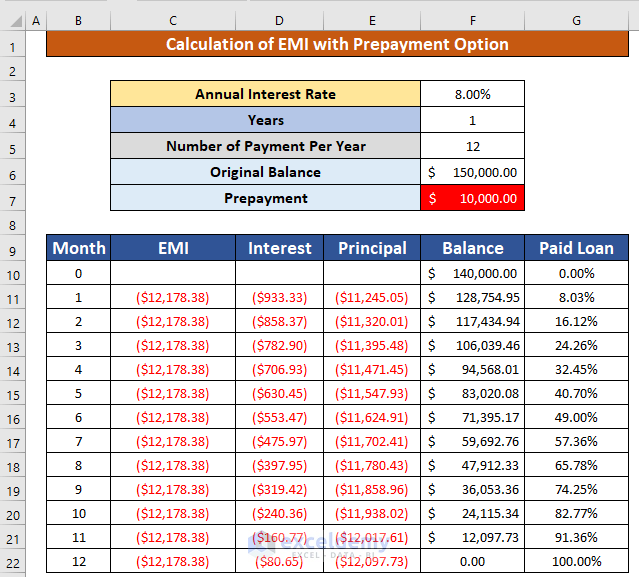

Emi Calculator With Prepayment Option In Excel Sheet With Easy Steps

How To Calculate The Principal Amount Paid In A Specific Month For A Loan In Excel 2016 Youtube

Loan Amortization Calculator

When Will I Begin Paying More Principal Than Interest

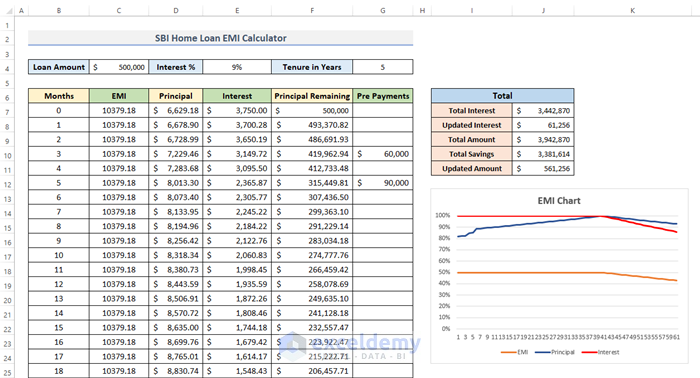

Sbi Home Loan Emi Calculator In Excel Sheet With Prepayment Option

Mortgage With Extra Payments Calculator

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com